Stock market

“Debt repayment”? What debts to be repaid? How to repay?

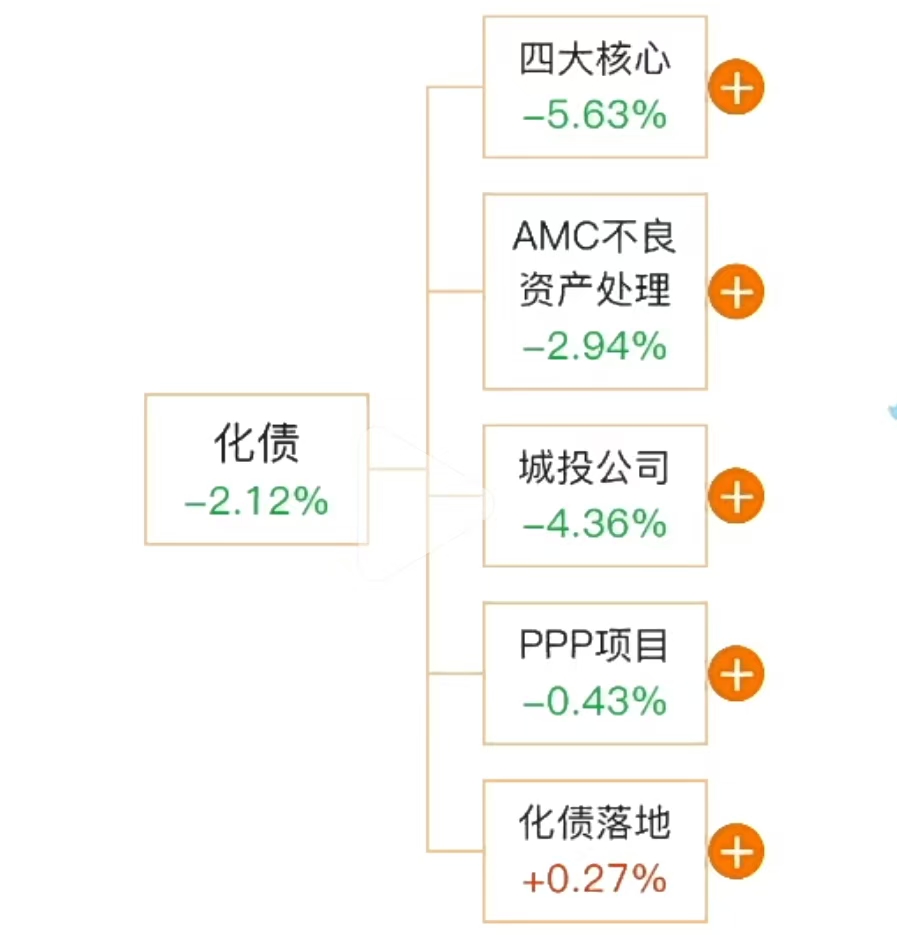

"10 trillion yuan debt reduction" - lighting the way forward for China's economy. This is not a simple numbers game. It means that in the next few years, the 6 trillion yuan local government debt limit will be used to replace the existing implicit debt in three years, plus 800 billion yuan of new local government special bonds will be used for debt reduction every year for five consecutive years, a total of 10 trillion yuan . This move will significantly reduce the total amount of implicit debt that needs to be digested by local governments from 14.3 trillion yuan to 2.3 trillion yuan before 2028. It is expected that the annual fiscal expenditure will increase by 1 trillion yuan, which can at least drive the GDP growth rate by 0.76%. How does it work? And what far-reaching impact will it have on the economy, people's livelihood and financial markets?

1. What is “debt reduction”?

We can compare the debt situation of local governments to a person who is in debt. This person not only borrowed money from small banks, but also borrowed a lot of money through various informal channels. The high interest rate and high repayment pressure caused him to be exhausted and his main business was also affected. The "10 trillion debt reduction" is like the country giving this person an opportunity to "go ashore", allowing him to borrow a large low-interest loan from formal channels and pay off those informal high-interest debts at one time. In this way, his repayment pressure is reduced, he can save a lot of money every month, and he has more energy to develop his own business. The same is true for local governments. By reducing debts, they can reduce interest expenses, reduce revenue and expenditure pressures, and free up more funds for economic development and people's livelihood security.

2. Basic Concept and Background of “10 Trillion Debt Reduction”

The so-called "10 trillion yuan debt reduction" does not simply mean that the state gives local governments a large sum of money to "repay debts" and write off previous debts. Instead, it converts implicit debts into explicit debts. So what is implicit debt? Simply put, it is government-backed, non-standard (not included in the debt limit) debt, characterized by high interest rates and mainly short-term debts. For example, some urban investment companies obtain high-interest loans through local government credit endorsements, which fall into the category of implicit debt. This debt model has brought a heavy burden to local governments and also hides certain financial risks.

The background of this measure is the pressure caused by the weak economic operation in the early stage. In recent years, affected by factors such as changes in the external environment and insufficient domestic demand, new situations and problems have emerged in economic operation. Tax revenue has fallen short of expectations, land transfer revenue has dropped sharply, and it has become more difficult to resolve hidden debts in various places. Against this background, the "10 trillion debt reduction" plan came into being and became an important measure to resolve local debt risks and promote economic development.

III. Specific implementation plan for “10 trillion yuan debt reduction”

The "10 trillion yuan debt reduction" specifically includes two parts: first, to increase the local government debt limit by 6 trillion yuan to replace the existing implicit debt, which will be arranged over three years, 2 trillion yuan per year from 2024 to 2026; second, starting from 2024, 800 billion yuan will be arranged from the new local government special bonds every year for five consecutive years, and a total of 4 trillion yuan of implicit debt can be replaced. After these policies work together, the total amount of implicit debt that local governments need to digest will drop significantly from 14.3 trillion yuan to 2.3 trillion yuan before 2028, and the pressure to reduce debt will be greatly reduced.

According to calculations by Galaxy Securities, based on the annual debt replacement scale of 2 trillion yuan, local government fiscal expenditure can be increased by at least 1 trillion yuan each year. Whether this part of the funds is used directly for fiscal expenditure related to people's livelihood or investment, it can drive effective demand to rebound. The increase in fiscal expenditure by 1 trillion yuan is expected to drive GDP growth by at least 0.76%.

IV. The pros and cons of the “10 trillion yuan debt reduction” initiative

Benefits:

For local governments : Debt reduction can optimize the local debt structure, reduce the pressure of interest payments, and allow local governments to unload their burdens and go into battle lightly. Local governments can devote more energy and resources to the field of people's livelihood security, such as improving the business environment, subsidizing the real estate market and consumption, and increasing investment in public services.

For economic development : Large-scale debt replacement is conducive to stimulating the recovery of effective demand, driving up private investment expectations and growth rates, and has a positive effect on promoting stable economic growth.

For the financial market : it helps alleviate the bad debt losses of financial institutions, reduce financial risks and stabilize the financial market.

Potential drawbacks:

Although the pressure to repay debt has eased, the total debt is still high, and local governments will still face a certain debt burden for some time to come.

Debt swaps may cause some local governments to develop an over-dependent mentality, resulting in a lack of sufficient constraints on debt management and fiscal spending, thus affecting fiscal sustainability.

6. Where to Go in the Future

Judging from the current situation, the "10 trillion yuan debt reduction" plan is an important measure taken by the Chinese government under the current economic situation, which has positive significance. In the future, as the debt reduction work progresses, the debt structure of local governments will continue to be optimized and the financial situation will gradually improve. At the same time, the government will also strengthen the management and supervision of debts to ensure the rational use of funds and promote the sustainable development of the economy. In this process, more supporting policies may be introduced to further support the development of the local economy and the improvement of people's livelihood security.

In short, the "10 trillion yuan debt reduction" plan is an important node in China's economic development. It not only solves the current debt dilemma for local governments, but also lays the foundation for the future development of the economy. We should view this move with a positive attitude and pay attention to its subsequent implementation effects.

The above content is purely personal opinion. If it is incorrect, it does not constitute any advice.

-

上一篇

Will express delivery be suspended during the 2025 Spring Festival? Here is the latest news

As the 2025 Spring Festival approaches, many consumers have ...

-

下一篇

Are depositors' deposits of 500,000 yuan absolutely safe? Bank president: You misunderstood. We will

In the financial world, bank deposits have always been a &qu...

相关文章

- Is Trump’s issuance of currency a way to make money or to “get involved”?

- Can Cao Dewang’s “Stanford dream” come true?

- Cancellation of outpatient prepayment and standardization of hospitalization prepayment will be offi

- “轻断食”“戒晚餐”“断碳水”,真的管用吗?国家新版减肥指南来了!

- 中国“零差评”的8个旅游景点,全部在北京,一生一定要去一次!

- 了不起的中国电动车!雅迪获认央视首期“国潮品牌”

- 中国品牌遍布全球200多个国家和地区——国货潮牌“圈粉”海外市场

- 25亿元卖出“问界”!刚刚,华为回应

- 女律师庭审现场遭法警争夺手机后被推倒,第三方律师称“法警行为并无法律依据”