Stock market

Are depositors' deposits of 500,000 yuan absolutely safe? Bank president: You misunderstood. We will

In the financial world, bank deposits have always been a "safe haven" in the minds of most people. After all, putting your hard-earned money in a bank is for peace of mind. However, this seemingly calm deposit field is actually full of mysteries.

Once upon a time, everyone thought that as long as the bank deposit amount was controlled within 500,000 yuan, it was like putting a solid safety lock on the funds, which was foolproof. But the reality poured cold water on us, and the bank president stood up to remind us: this idea is totally wrong! Next, let's talk about the tricks in it.

Let's talk about the bank deposit insurance system first. Walking on a busy commercial street, if you pay attention to the facades of large state-owned banks or walk into the bank hall, you will find deposit insurance logos posted on the wall or in a prominent position. This is not a simple decoration, it represents a key link in my country's deposit insurance system. As of the end of 2023, 3,939 banking financial institutions have participated in it. However, this does not cover all domestic banking institutions, and there are still more than 600 outside the system. What does this mean? If you deposit money in a bank that does not participate in the deposit insurance policy, even if the deposit does not exceed 500,000, it will be difficult to get compensation when something goes wrong. Imagine that you happily deposited your money in a small bank that looks quite reliable, but one day the bank was not doing well, and you went to ask for the redemption of your deposit, but the bank told you that they did not participate in insurance. It was really a tearful moment.

Let's talk about those dazzling financial products. Nowadays, technology is advanced, and online payment and online bank branches are everywhere. Ordinary people like us hold smart phones and click on a link at random, and all kinds of bank financial products, funds, and stock investment products will appear in front of us. In order to attract customers, some bad financial institutions use very exaggerated propaganda, and very tempting words such as "capital preservation" and "stable growth" are everywhere. Many people don't know the truth and invest their money in it. But do you know? The bank deposit insurance system only covers regular bank deposit financial management, such as bank time deposits.

Once you buy a non-deposit financial product, such as being fooled into buying a high-risk fund, and end up losing all your money, it is impossible for you to ask the bank to pay you according to the deposit insurance. There was such a grandfather who originally wanted to deposit his retirement money in a fixed deposit, but was persuaded by the bank staff to buy a so-called "high-yield financial product". In the end, he not only did not make any money, but also lost a lot of his principal. He regretted it so much that he stamped his feet.

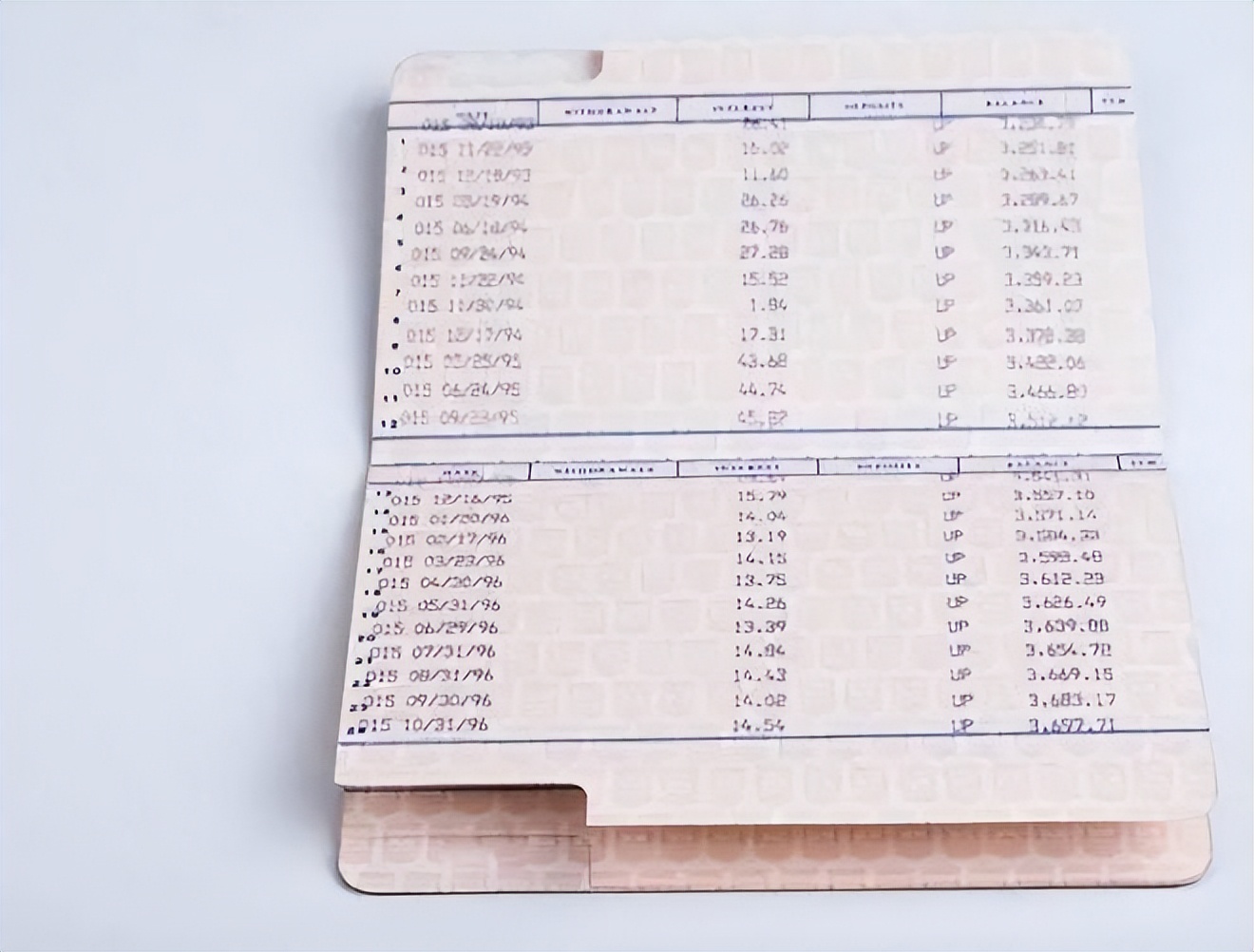

There are also such annoying things as theft of deposits or loss of passbooks. Now when banks withdraw large deposits, the process is still quite strict, and depositors will be required to verify their identities. However, it is not so troublesome to withdraw money from ATMs, and no identity documents are required. This leaves some criminals with opportunities to take advantage of. Therefore, we must develop the good habit of checking the balance of bank accounts regularly, and the deposit certificates or passbooks must be properly kept. If the bank goes bankrupt one day and you can't find the deposit certificate or passbook, even if the bank has an obligation to pay, you can only worry. There was a young man who was careless at ordinary times and put his passbook away casually. As a result, he couldn't find it when he needed money. It happened that at this time, there were some rumors about the bank's poor management. He was as anxious as an ant on a hot pot, looking for the passbook everywhere, for fear that his deposit would be wasted.

Next, we have to mention the serious problem of bank insiders misappropriating depositors' deposits. You may think that bank employees are under the control of the bank. If they dare to misappropriate depositors' deposits, the bank must be responsible for compensation. And it feels that this kind of thing is far away from you. But the reality is often cruel. If this really happens, as long as the depositor can produce a legal deposit certificate, the court will definitely support the claim for compensation. But if the bank is about to go bankrupt or has already gone bankrupt before discovering that the deposit has been misappropriated, it will be extremely difficult to recover the money. Even if the money can be recovered through legal means in the end, the time, energy and money spent during this period are huge. For example, an employee of a bank took advantage of his position to secretly misappropriate the deposits of several depositors to invest in some high-risk projects, and ended up losing a lot of money. By the time the depositors found out, the bank had already encountered a serious financial crisis.

In order to protect their rights, depositors have been running around, looking for lawyers, and collecting evidence, which has exhausted them both physically and mentally. Once those who participated in stealing depositors' deposits are caught, they will face heavy penalties, including criminal liability, civil compensation, industry bans, and property confiscation. The court will make different judgments based on factors such as the motive, method, and amount of theft, making these criminals pay a heavy price for their actions.

Finally, let's talk about the situation where you disclose sensitive deposit information and cause losses. In life, we will inevitably participate in various social occasions, and sometimes when we are happy, we may speak without restraint. But you don't know that this may bring huge hidden dangers to the safety of deposits. Especially some elderly people, they are not very good at using online banking apps, and it is not convenient for them to go to bank branches to handle business. If there is no help from their children, they may entrust bank employees or old acquaintances to operate on their behalf. This is very easy to cause problems. There was once an old lady who asked a person in the community who claimed to work in a bank to help withdraw some money because of her inconvenient legs and feet. As a result, this person saw the money and secretly transferred part of the old lady's deposits. Fortunately, the bank later found some abnormalities in the monitoring and reported to the police in time, so that part of the loss was recovered. Now many banks have realized this problem and launched door-to-door agency services, which provide great convenience for the elderly and also guarantee the safety of their deposits to a certain extent.

Looking at the current economic situation, the domestic economy is facing downward pressure, the Federal Reserve is still raising interest rates, and global wealth is being harvested. In this environment, domestic banks are not having a good time, and news of bank bankruptcies comes from time to time. Names like Hainan Development Bank and Baoshang Bank once had a certain degree of popularity in the financial field, but in the end they couldn't hold up. The Henan Village Bank crash in 2022 was even more sensational, and people all over the country were paying attention. Although these incidents have been properly handled with the efforts of government departments, it has also made everyone more worried about the safety of deposit insurance.

For young people, financial management concepts are more diversified, and bank financial products, funds, bonds, stocks, etc. are all within their consideration. After all, relying solely on bank deposits may not keep up with the pace of wealth growth in this era. But for the elders born in the 1950s to 1970s, bank deposits are still their most trusted way of financial management. This is not difficult to understand. Other financial management methods are not covered by the deposit insurance system and are relatively risky.

In the current banking dilemma, how should we choose a financial management method? If you pursue absolute safety, it is a good choice to put the bulk of the funds in bank deposits. If you can bear a certain amount of investment losses, you may be able to earn high returns by properly allocating some funds or stocks in familiar industries. For families who do not want to take risks, you can also consider allocating some investment gold products. But no matter what you choose, investment and financial management knowledge must be mastered.

Take the example of my neighbor, Brother Zhang, who is a typical conservative investor. He always thinks that it is safest to keep money in the bank, so most of his savings have been kept in bank deposits for many years. But later, after listening to some financial lectures and understanding the pros and cons of different financial management methods, he began to re-examine his financial planning. Although bank deposits are still the main source, he also took out a small part of the funds to buy some low-risk funds. Slowly, the asset returns have also increased to a certain extent. My friend Xiao Li is a young financial practitioner. He is familiar with various financial management methods, so his financial management configuration is more diversified. In addition to bank deposits, he has also invested in some high-quality stocks and bonds. Of course, he will always pay attention to market trends and adjust the investment portfolio in a timely manner to ensure the safety and income of assets.

In the seemingly simple field of bank deposits, there are actually many details that we need to pay attention to. We can no longer blindly believe that bank deposits of less than 500,000 yuan are absolutely safe. When making financial planning, we must consider carefully and fully understand the various possible risks and countermeasures. Only in this way can we protect our wealth and realize the preservation and appreciation of assets in a complex financial environment.

Now the services of banks are also constantly upgraded. In addition to the door-to-door agency services mentioned above, many banks have also launched online financial consulting, risk assessment and other functions. We can use these tools to better understand our financial situation and risk tolerance and make more reasonable financial decisions. At the same time, we must also remain vigilant and not be dazzled by the temptation of some high returns. When facing various financial products, we must carefully read the contract terms and understand the risk level and return of the products. If there is anything we don’t understand, we must consult professionals in time.

In the days ahead, with the development of the economy and changes in the financial market, financial management methods will continue to innovate and evolve. We must continue to learn and keep up with the times in order to be more stable on the road of wealth management. Whether it is bank deposits or other financial management methods, we need to operate and manage them carefully so that our wealth can create a better life for us.

When we consider bank deposits and other financial management methods, we can also pay attention to the country's macroeconomic policies. For example, when the country introduces some policies to encourage the development of the real economy, funds and stocks in related industries may usher in development opportunities; and when monetary policy is loose, the interest rate of bank deposits may decline. At this time, we need to re-evaluate the proportion of bank deposits in the financial management portfolio.

In addition, we can also refer to some professional financial research reports and industry analysis to understand the development trends and potential risks of different financial management methods. For example, some authoritative institutions will analyze and predict the yield trend of bank financial products and the performance of funds. This information can help us make more informed decisions.

In daily life, we can also exchange financial management experiences with friends and family around us. Everyone's financial management experience is a valuable asset. Through sharing and communication, we can learn more financial management skills and methods and avoid some common mistakes. For example, some friends may have accumulated some stock selection experience when investing in stocks, and some friends may have discovered some details that need to be paid attention to when purchasing bank financial products. These experiences can be learned from each other.

In short, on the road of financial management, we must maintain a cautious, rational and learning attitude, constantly explore financial management methods that suit us, protect our wealth, and lay a solid foundation for our future life. Let us become the master of our own wealth and create a better life in this financial world full of opportunities and challenges.

When faced with various financial temptations, we must stick to our principles and not blindly follow the trend. For example, when P2P online lending was popular a few years ago, many people were attracted by the high returns and invested a lot of money. As a result, with the collapse of the P2P industry, a large number of investors lost all their money. This is a painful lesson of not fully understanding the risks of financial products. We must learn lessons from these cases and have a comprehensive understanding and evaluation of the product background, operating model, risk control and other aspects when choosing a financial management method.

At the same time, we should also focus on cultivating our financial literacy. We can improve our understanding and application of financial knowledge by reading financial books and participating in financial training courses. Only with sufficient financial literacy can we make correct judgments and decisions in the complex financial market.

In family financial management, the couple or family members also need to fully communicate and negotiate. Different people may have different financial management concepts and risk tolerance. Through communication and negotiation, a consensus can be reached and a more reasonable family financial management plan can be formulated. For example, some family members may be more conservative and tend to save more in bank deposits; while some family members may be more willing to try some new financial management methods and pursue higher returns. In this case, both parties need to understand and compromise with each other to find a balance.

In the future financial market, the application of technology will become more and more extensive. Technologies such as artificial intelligence and big data will provide more accurate services and suggestions for financial management. We should actively embrace these new technologies and use them to support our financial management decisions. For example, some smart financial management platforms can recommend personalized financial management plans for us based on our consumption habits, asset status and other information.

But while enjoying the convenience brought by technology, we must also pay attention to protecting the security of personal information. When using online financial services, we must choose formal platforms and channels and avoid operating in an unsafe network environment. At the same time, we must change passwords regularly and set complex password combinations to prevent personal information from being leaked.

In short, financial management is a long-term practice that requires us to constantly learn, practice and summarize experience. In this process, we must pay attention to various factors, including the security of bank deposits, the diversity of financial management methods, changes in the financial market, the impact of national policies, etc. Only by comprehensively considering these factors can we formulate a financial planning that suits us, achieve steady growth of wealth, and make our lives better. Let us work together to keep moving forward on the road of financial management and welcome a better future.

相关文章

- Special report on the stock market | Another divorce case with sky-high prices in the A-share market

- The global stock market is changing rapidly. A full analysis of the latest developments of A-shares,

- Sichuan: Real estate development investment in 2024 will drop by 9.9% compared with the previous yea

- What are the clues for investment in 2025? Dai Yi of Changsheng Fund: Technological growth may still

- The peak of childbirth at the end of the year! There are 4 types of baby insurance that are really p

- Treating major news events as advance orders, an air force regiment was highly prepared after the st

- Strengthen your skills for real warfare! A brigade of the Northern Theater Air Force improves the jo

- The world's top 10 air forces are revealed. India beats China completely? Chinese netizens: "Th

- What are the two buttons on the Eighth Route Army's hats? You will know how clever they are after re

- There are no aircraft carriers or 055 destroyers. Why is the Eastern Theater Command known as the &q