Text|Liu Jianzhong and Chen XiPredicting the new year has become a habit for major securities firms, research institutions, and financial media. In fact, I have many doubts about predicting the future, because a black swan event or a policy adjustment can change the course of history. Compared with the macro economy, the market is more difficult to predict. Therefore, the so-called prediction is just to sort out ideas and sort out the most noteworthy economic and political factors.Let's first review my "Top Ten Predictions for the Global Economy in 2024". From the results, I found that seven of the ten predictions were correct. The correct ones included the judgments on the US economy, the Chinese economy, the gold price, the copper price, the A-shares, the Hong Kong stock market, and the recovery industries in 2024. The wrong ones were the judgments on the US dollar index, the RMB/USD exchange rate, and the US stock market trend.Let’s start with the predictions for 2025.Let me first state the premise for all the following predictions: no black swan event occurs in the U.S. economy.In 2025, there is a possibility of a black swan event in the US economy. For example, if the Bank of Japan raises interest rates by a large margin in 2025, it will affect a large number of carry trades between the US and Japan, and may cause a sharp drop in the US stock market. US residents have poor risk resistance, and once financial risks occur, the risks are easy to spread. If a black swan event occurs, all forecasts need to be re-evaluated.Our top ten predictions are as follows:

US economy grows modestly

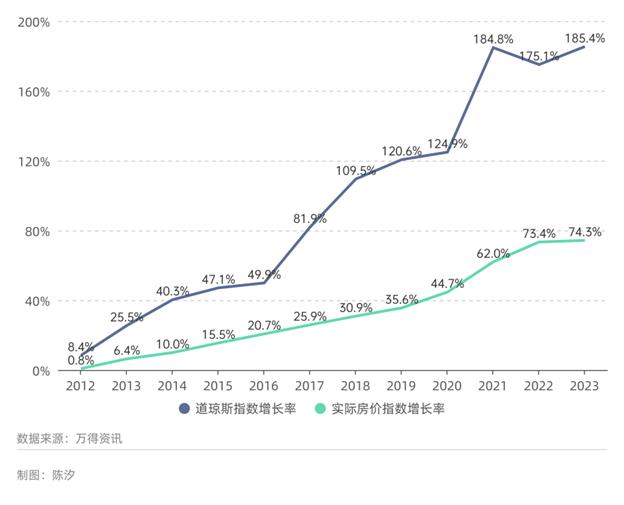

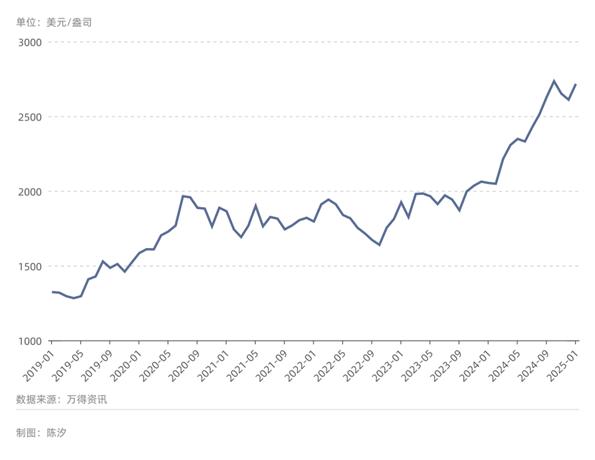

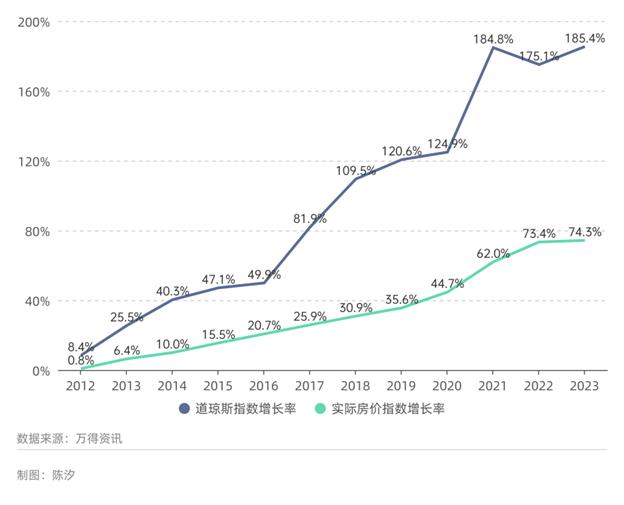

The main driving force of the US economy is household consumption. Both the US stock market and the housing market have experienced a bull market for more than ten years (Figure 1), creating a huge wealth effect. Under the wealth effect, household consumption will continue to grow in 2025, although it will be weaker than in 2024, but still strong.

Figure 1: U.S. stock and housing market gains relative to 2011Since September 2024, the Federal Reserve has cut interest rates three times in a row, a total of 100 basis points, which will have a positive impact on investment and consumption.Trump's coming to power on January 20, 2025 will have a two-sided effect: relaxing business regulations will be conducive to economic growth, while tightening immigration policies and provoking trade frictions will have the opposite effect.The forecasts of major US institutions for the US GDP (gross domestic product) growth rate in 2025 are concentrated between 1.8% and 2.8%. Our forecast is that the US GDP growth rate in 2025 will be lower than that in 2024, but greater than 2%. In fact, the exact value is not that important. Readers only need to know that the US economy is likely to maintain moderate growth.

US stocks fall

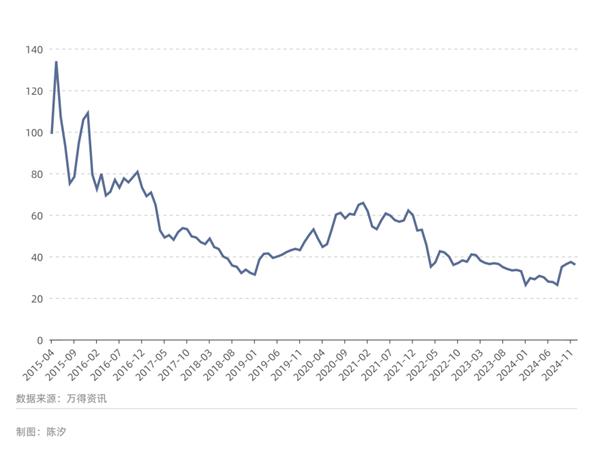

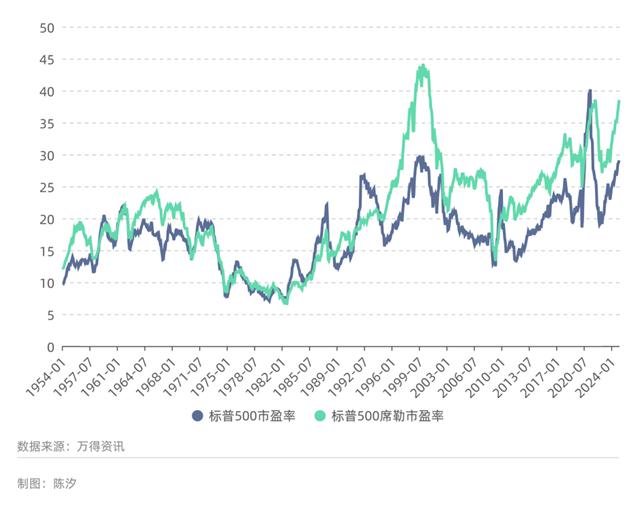

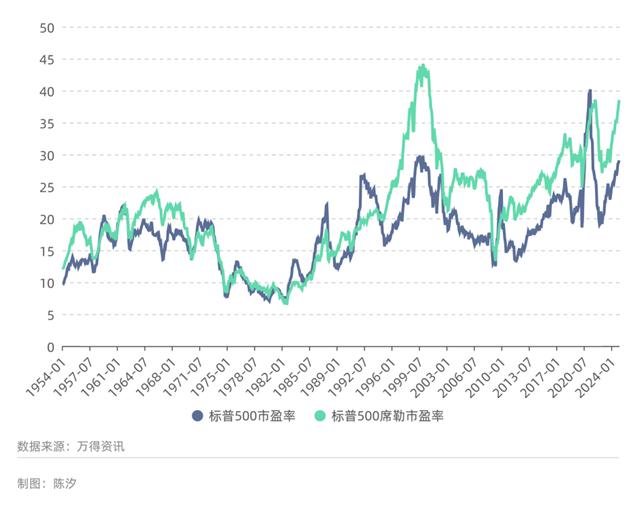

The biggest problem with the US stock market right now is that valuations are high. Figure 2 shows the S&P 500 P/E ratio and the S&P 500 Shiller P/E ratio. It is not difficult to see that the Shiller P/E ratio is close to its historical high.

Figure 2: S&P 500 P/E Ratio, S&P 500 Shiller P/E RatioThe Shiller P/E ratio was proposed by Professor Robert Shiller, the 2013 Nobel Prize winner in Economics. The idea behind it is simple: using the "ten-year average net profit" to replace the current year's net profit, thereby eliminating the numerical fluctuations caused by cyclical changes in profits. A high "Shiller P/E ratio" usually requires one of the following two conditions to be met:First, the economy will grow rapidly in the future;Second, the cost of capital is very low, or it is expected that the cost of capital will become very low in the future.At present, neither of the above two conditions is met. For the first one, the growth rate of the US economy in 2025 will be lower than that in 2024, and in 2026 it will most likely be lower than that in 2025. For the second one, the cost of capital will indeed decrease in the future, but the decrease will not exceed 100 basis points. Therefore, the high valuation of US stocks lacks solid support.In fact, the main driver of the growth of the S&P 500 index since 2023 has come from giant technology companies. However, the promised results of the AI revolution will still be difficult to deliver in 2025, and the valuations of such companies have a greater downside risk. We expect the US stock market to fall in 2025.

China's domestic demand improves

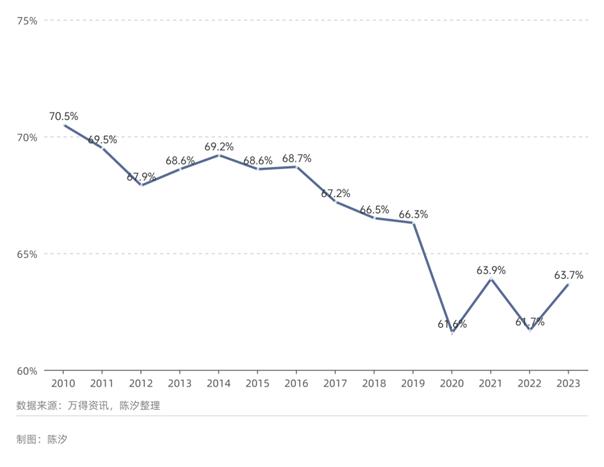

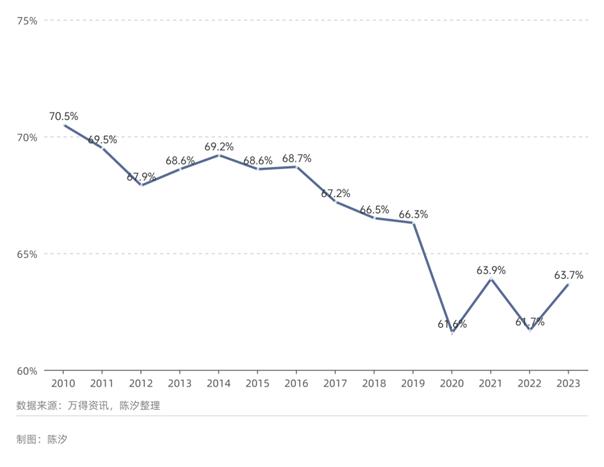

"Residents' consumption propensity" refers to the proportion of residents' consumption expenditure in disposable income. Figure 3 shows that due to the impact of the epidemic in 2020, the consumption propensity of urban residents dropped sharply. Since 2022, house prices have fallen and residents' wealth has shrunk, resulting in residents' consumption propensity in 2023 not returning to the level before the epidemic.In the first three quarters of 2024, the consumption propensity of urban residents was 62%, higher than 61.7% in the same period of 2023, but still lower than 63.8% in the same period of 2019 before the epidemic. With the repair of the balance sheet of the household sector, we expect the consumption propensity of residents to rise further in 2025.Local government spending will also increase in 2025. Since 2023, local governments have worked hard to improve their debt situation; a series of policies introduced in 2024 will help local governments resolve debt pressure. Under these conditions, local governments can pay more of their debts and increase necessary spending.Although the increase in US tariffs will have an impact on China's economic growth, Morgan Stanley, Deutsche Bank and other institutions believe that the negative impact on China's GDP growth in 2025 will be less than one percentage point. Moreover, China has many countermeasures. In short, there is no need to be overly pessimistic about 2025. Figure 3: China’s urban residents’ consumption propensity (2014-2023)

Figure 3: China’s urban residents’ consumption propensity (2014-2023)RMB exchange rate against the US dollar fluctuates within a narrow range

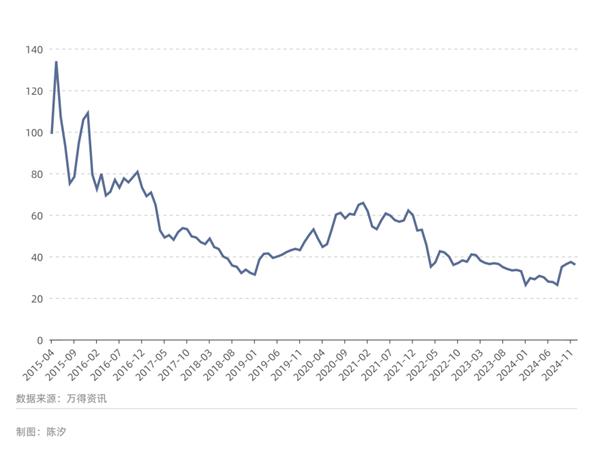

The RMB/USD exchange rate is one of the most important prices in the market and the basis for many other forecasts.If Trump imposes a large tariff increase after taking office, the depreciation of the RMB is an optional hedging tool for China. However, the RMB will not depreciate significantly against the US dollar for a long time. Of course, there is no reason for the RMB to appreciate significantly against the US dollar in 2025.The long-term trend of the RMB is appreciation, because China can maintain a relatively stable trade surplus. Figure 4 shows that China's trade surplus has always been positive since 2005, and the ratio of China's trade surplus to the world's total GDP has always remained between 0.2% and 0.8%.

Figure 4: Ratio of China’s trade surplus to world GDPIt is important to know that from 2005 to now, we have experienced the 2008 subprime mortgage crisis, the 2018 US trade war, and the 2020 COVID-19 pandemic. However, despite these significant unfavorable factors, China's trade surplus has remained relatively stable.Why is China's trade surplus relatively stable? Because China is the world's factory, and most of China's imports are raw materials or intermediate products. When exports are restricted and products cannot be sold, China's imports will also decrease, but China can still earn the price difference between imported goods and finished products, forming a trade surplus.Since the long-term trend of the RMB is appreciation, China does not need to be afraid of temporary depreciation. The author believes that if the US tariff pressure is too great, the RMB may as well depreciate sharply and quickly at one time.Slow depreciation will create expectations that the RMB will continue to depreciate in the future. In order to avoid the risk of depreciation, capital is unwilling to hold RMB and RMB assets. This will have many adverse effects, such as a sluggish stock market.If the RMB depreciates by 10%-15% at one time, making it undervalued, the market will have expectations of RMB appreciation. At this time, the attractiveness of RMB assets will increase, which will attract capital inflows. The RMB does not need to be afraid of depreciation, but what the RMB is afraid of is the expectation of long-term depreciation.

Hong Kong stocks neutral

The Hong Kong dollar is anchored to the US dollar, which makes the RMB exchange rate against the US dollar one of the most important factors affecting the Hong Kong stock market. The reasons are as follows: Hong Kong stocks' assets are mainly in mainland China. Assuming that the returns of these assets remain unchanged in 2025, but the RMB depreciates by 5%, then the returns in Hong Kong dollars will drop by 5%. Coupled with the amplification effect of the stock market, the decline of Hong Kong stocks is likely to exceed 5%.In 2025, many institutions expect that the RMB will depreciate slightly against the US dollar, and the overall profits of Hong Kong-listed companies will not improve significantly. Therefore, from the perspective of exchange rate, Hong Kong stocks are bearish.However, the cost of funds for Hong Kong stocks will be further reduced in 2025, because the Hong Kong dollar will follow the US dollar interest rate cut. At present, the market's expected US dollar interest rate cut has a tendency to increase. Therefore, from the perspective of interest rates, Hong Kong stocks are bullish.Under the influence of the above two forces, we expect the Hong Kong stock market to be neutral, with the Hang Seng Index fluctuating between -10% and +10%.

The bottom of A-shares has appeared

In 2025, the A-share market will still have loose capital. Although the improvement in corporate profits is limited, cash flow will improve. Will the A-share market have the foundation for a big bull market in 2025? The answer is no. The fundamental reason is that except for the banking, coal, oil, telecommunications and other sectors, the price-earnings ratios of other sectors of the A-share market are still relatively high.For example, the current price-earnings ratio of the Shenzhen Stock Exchange's ChiNext is still more than 30 times, which can only be considered reasonable, not undervalued. Although the price-earnings ratios of banks, coal and other sectors are low, they are not undervalued due to the expected decline in future profits. The premise of a big bull market is often the deep underestimation of the market.But what we emphasize is that the bottom of A-shares in 2025 is solid, the policy's protection of A-shares is obvious to all, and funds are loose. Therefore, there will be no more 3,000-point defense battle in 2025.

Figure 5: Shenzhen Stock Exchange ChiNext P/E Ratio

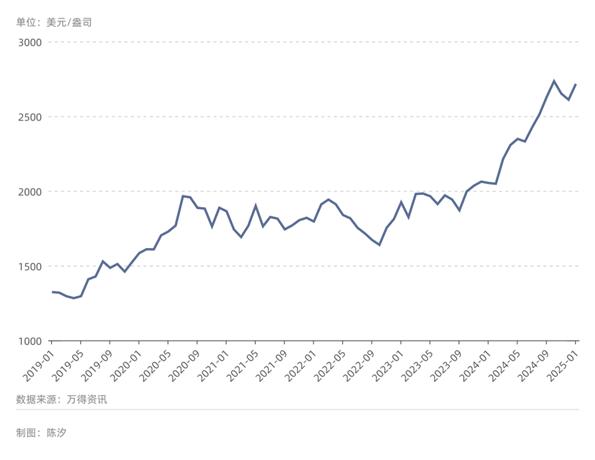

Gold range-bound

As can be seen from Figure 6, the London gold spot price began to hit $2,000/ounce in July 2020, and it was not until January 2024 that it was considered a breakthrough, which took more than three years. Therefore, it is difficult to break through the integer mark of $3,000/ounce in one fell swoop. Moreover, the current upward momentum of gold is suppressed by the strong dollar, and the market also has expectations for Trump's new policies, but most of Trump's policies are not conducive to the rise of gold. Therefore, it is difficult for the gold price to break through $3,000/ounce in 2025.

Figure 6: London spot gold price (monthly closing price)Gold is still in a bull market. There are always one or more driving factors in a gold bull market. If this factor does not dissipate, the gold bull market will not end. The driving factor of this gold bull market is the US dollar debt problem. There is no solution to this problem at present. Therefore, the gold bull market has not ended. However, as long as the debt problem does not deteriorate significantly, the gold market in 2025 will be relatively flat.After suspending its holdings for several months, the People's Bank of China increased its gold holdings again in December 2024, at a price above $2,600/ounce. This price can be regarded as the bottom of the gold price. A short-term drop below $2,600/ounce is possible, but a long-term drop below $2,600/ounce is less likely. Therefore, the gold price in 2025 will fluctuate between $2,600/ounce and $3,000/ounce.In the predictions about gold in 2024, the author made a special prediction: in 2024, news about the discovery of a large gold mine in China will become a hot topic in the news. Xinhua News Agency reported on December 2 that the Hunan Provincial Institute of Geology announced that more than 40 gold veins were discovered more than 2,000 meters underground in the Wangu gold mine in Pingjiang County, and the cumulative gold resources discovered in the core exploration area reached 300 tons. The prediction came true.In 2025, we expect that there will still be news of the discovery of large gold mines in China.

Real estate prices have yet to bottom out

In September 2024, many new policies for the real estate market were introduced, and the residential transaction volume in first-tier cities increased significantly. Wind data showed that in the third and fourth weeks of October 2024, the second-hand housing transaction area in Beijing, Shanghai and Shenzhen increased by 66.8%, 80.6% and 140.4% respectively compared with the same period in September.In December 2024, statistics from China Index Academy showed that housing prices in many second-tier cities rebounded month-on-month. The month-on-month increases in housing prices in Nanjing, Xi'an, and Chengdu were 0.85%, 0.74%, and 0.68%, respectively.However, we cannot judge whether the real estate prices in first- and second-tier cities have truly bottomed out. Moreover, we believe that real estate in third-tier and lower cities still does not have good allocation value.

Promising industries

In 2025, we are optimistic about four industries: gold, consumer electronics, home appliances, and glass fiber.In 2025, the profits of gold companies will continue to rise; under policies to stimulate consumption, the profits of companies related to the consumer electronics and home appliance industries will also increase.The glass fiber industry is greatly affected by real estate and infrastructure, and the recovery will be slow. However, the total inventory of eight A-share listed companies in the glass fiber industry in the third quarter of 2024 was 11.86 billion yuan, which is significantly lower than 13.25 billion yuan in the same period of 2023, indicating that the industry has begun to destock. Glass fiber will gradually replace other materials due to its superior material properties and low price. We are optimistic about the long-term growth of this industry.

Negative industries

In 2025, we are pessimistic about four industries: liquor, coal, electricity, and phosphate rock.The liquor industry has a backlog of inventory, and its profits will decline in 2025. Coal prices are likely to fall. The market-oriented reform of electricity continues to advance, and China's electricity supply will be abundant in 2025, which will affect the profits of power generation companies. In addition, phosphate rock prices are likely to fall in 2025.

Figure 3: China’s urban residents’ consumption propensity (2014-2023)

Figure 3: China’s urban residents’ consumption propensity (2014-2023)