Important news

Thunderstorm! The performance of 8 major semiconductor chip leaders collectively collapsed! Among th

The recent 2024 annual report performance forecast has been released, and there are many companies with performance crashes, such as the semiconductor chip field, pharmaceutical field, military electronics field, consumer electronics field, power and general equipment field, etc., all of which have experienced performance crashes. At present, I have sorted out 8 leading semiconductor chip companies with performance crashes, among which Shanghai Silicon Industry is also controlled by the National Big Fund, and VeriSilicon shares are also held by the National Big Fund, but they still have performance crashes. The specific situation is as follows:

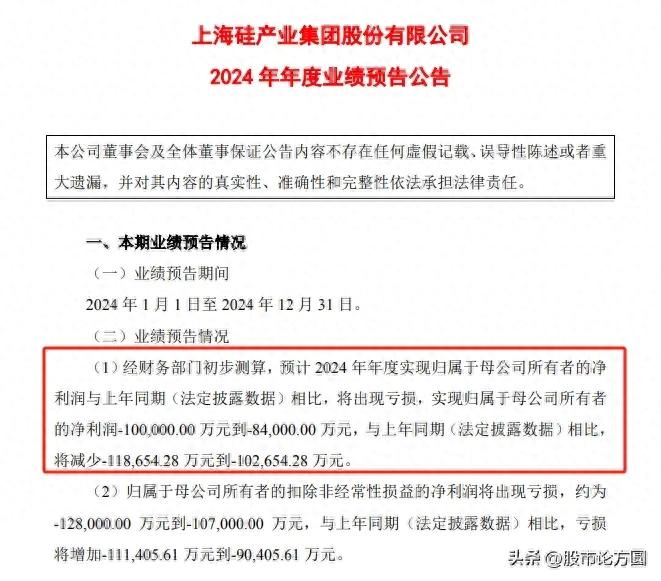

The first Shanghai Silicon Industry

Shanghai Silicon Industry is a leading company in the semiconductor silicon wafer industry. The company is also a leading company in the field of large-size semiconductor silicon wafers in China, especially in the field of 300mm semiconductor silicon wafers. It is one of the first companies in China to achieve large-scale sales. However, Shanghai Silicon Industry's performance in 2024 suffered a serious loss. It is expected that the company's net profit in 2024 will be between 840 million yuan and 1 billion yuan, which will be reduced by -1.187 billion yuan to -1.027 billion yuan compared with the same period last year.

The main reason for the loss of Shanghai Silicon Industry's performance is that the market recovery is not as expected. Because the recovery speed of the global semiconductor silicon wafer market is not as fast as expected, the unit price of the company's main product, 300mm semiconductor silicon wafers, has dropped. Although sales have increased, overall profits have been affected. In addition, the unit price of Shanghai Silicon Industry's products is also declining. The reason is that the sales volume of the company's 200mm semiconductor silicon wafers has remained basically flat with a slight decline, and the unit price of some products has dropped significantly due to market influence, which has further compressed the profit margin. In addition, Shanghai Silicon Industry insists on a high level of R&D investment, which has also had a negative impact on performance in the short term.

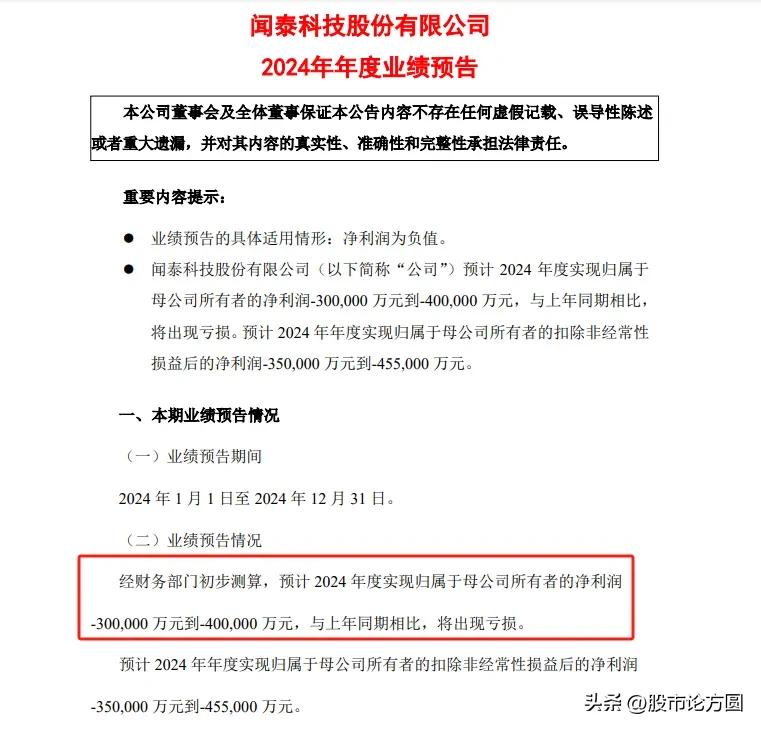

The second Wingtech Technology

Wingtech Technology is the world's leading mobile phone ODM leader, and the company also has a significant market position in the semiconductor field. In addition, Wingtech Technology has outstanding performance in the global automotive semiconductor field. In the first half of 2024, 63% of its semiconductor business revenue came from automotive scenarios, and currently 90% of Wingtech Technology's semiconductor products meet automotive-grade standards, with a product defect rate as low as one billionth. However, Wingtech Technology expects a net profit loss of between 3 billion and 4 billion yuan in 2024, which will be a serious loss compared with the same period last year.

The main reason for Wingtech Technology's 2024 performance loss is that its product integration business (ODM business) has limited voice in the industry chain, is squeezed by upstream and downstream prices, and has a small profit margin. Moreover, the global semiconductor market has entered a downward cycle since the fourth quarter of 2022, and the revenue, gross profit margin and profit of the semiconductor business have all declined. In addition, domestic semiconductor manufacturers are competing to enter the market and the competition in terminal markets such as mobile phones is also fierce, which has led to some of the company's products facing low-price competition and passive compression of profit margins.

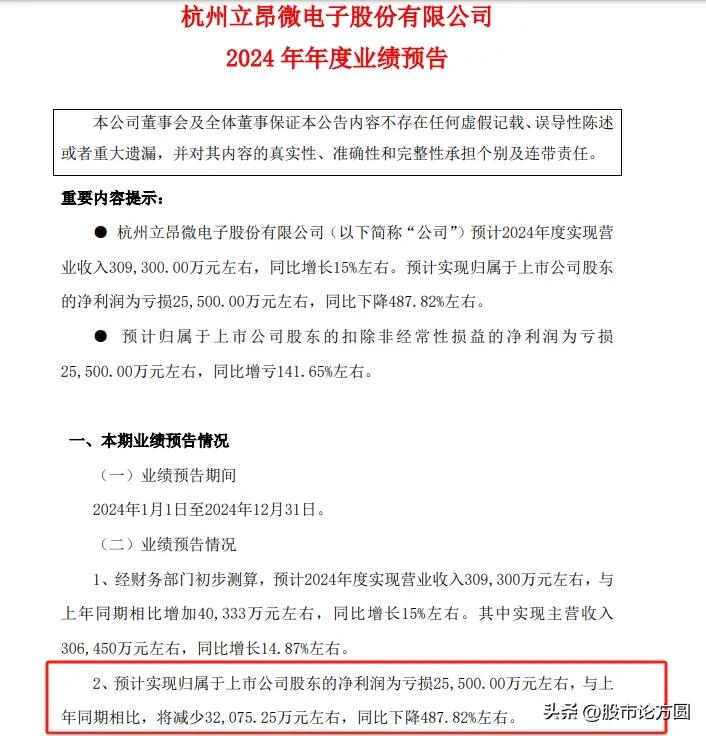

The third company, Lianwei

Lion Micro is a leading company in the field of domestic silicon wafers. Since its establishment, the company has been focusing on the design, development, manufacturing and sales of related products such as semiconductor silicon wafers and semiconductor power devices. After years of development, it has accumulated rich experience and first-mover advantages in technology research and development, business management, customer retention, etc., and has become a leading company in the two sub-industries of domestic semiconductor silicon wafers and semiconductor power devices. However, Lian Micro expects a net loss of about 255 million yuan in 2024, a year-on-year decrease of about 487.82%.

The main reason for the loss of Lianwei in 2024 is the increase in depreciation and amortization expenses. That is, as the expansion projects in 2023 are gradually converted, the depreciation and amortization expenses in this reporting period are about 938 million yuan, an increase of about 206 million yuan year-on-year. In addition, in order to expand its market share, Lianwei has lowered the prices of semiconductor silicon wafers and semiconductor power device chips.

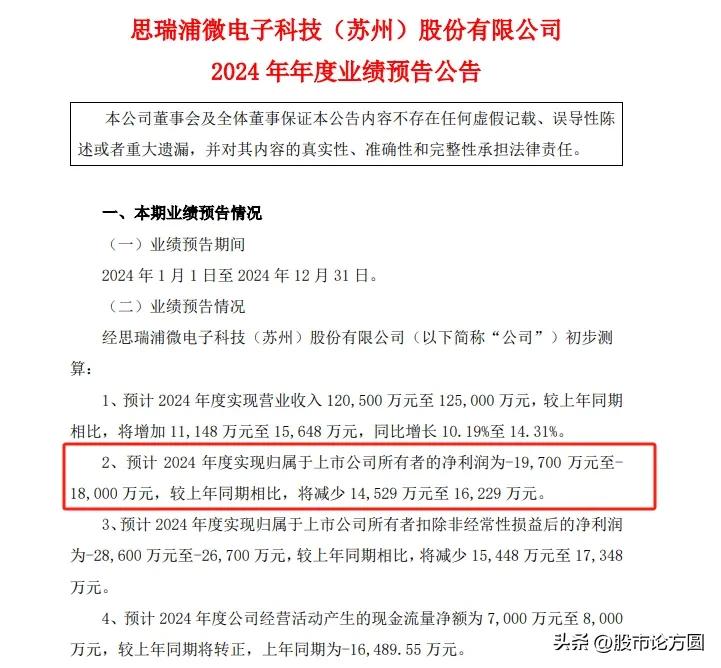

The fourth store is Si Rui Pu

SiRuiPu is a leading company in the analog chip industry. The company focuses on the research and development and sales of analog integrated circuit chips. Its main products include signal chain analog chips, power management analog chips and embedded processors, which are widely used in communications, consumer electronics and industrial control. SiRuiPu expects its net profit to be a loss of between 197 million yuan and 180 million yuan in 2024, which will be a decrease of 145.29 million yuan to 162.29 million yuan compared with the same period last year.

The main reason for SiRuiPu's 2024 performance loss is that changes in the market environment have had a significant impact on SiRuiPu's performance. The global economic situation in 2023 is relatively severe, especially in the chip industry, with rising raw material costs and distributors' inventory backlogs, which squeezed profit levels. In addition, intensified competition and innovation bottlenecks are also important reasons for the loss. In addition, inventory management issues have also increased the company's financial burden.

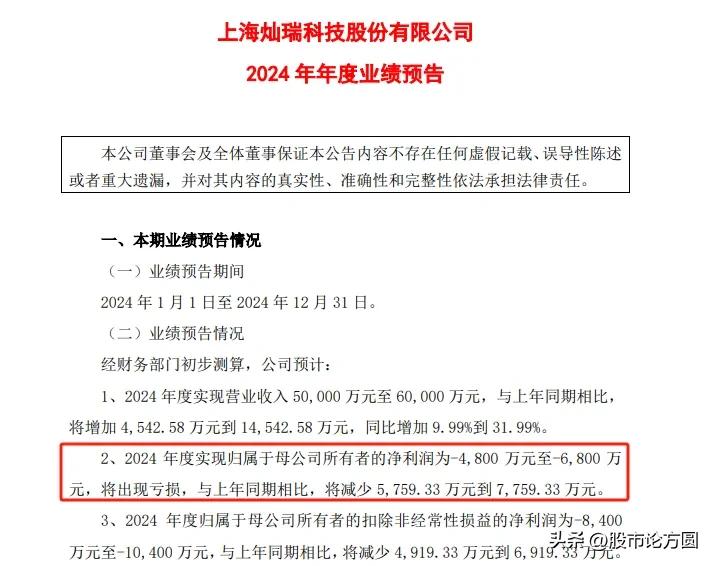

The fifth company: Canrui Technology

Canrui Technology is a leading company in the field of magnetic sensor chips. The company focuses on the research and development, design, packaging, testing and sales of high-performance mixed-analog integrated circuits and analog integrated circuits. Its main products include magnetic sensor chips, optical sensor chips, power management chips and packaging and testing services, which are widely used in smart homes, smart phones, computers, wearable devices, industrial control and automotive electronics. Canrui Technology expects its net profit to be a loss of between 48 million and 68 million yuan in 2024, which will be a decrease of 57.5933 million to 77.5933 million yuan compared with the same period last year.

The main reason for Canrui Technology's loss in 2024 is that fierce market competition has led to a drop in product prices, and the company's R&D investment is also increasing. In addition, the prices of some of the company's power management chips are still under certain pressure, resulting in the company's gross profit margin being at the bottom range.

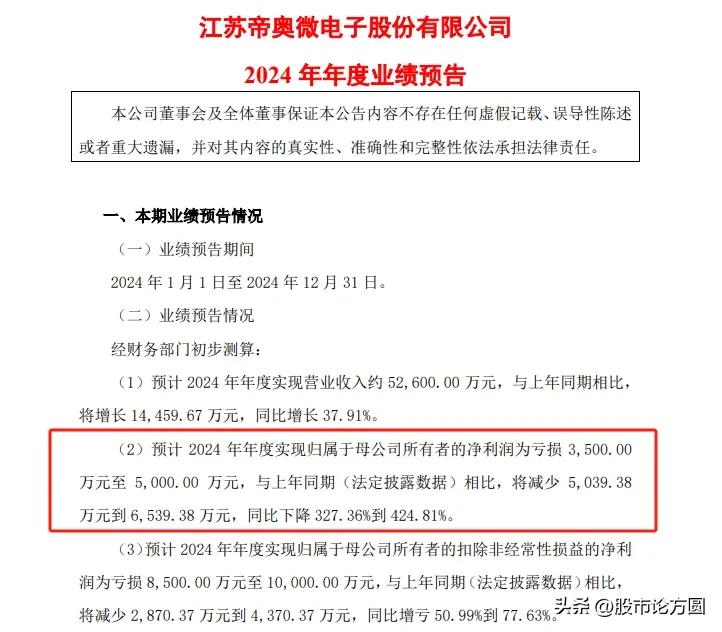

The sixth company: Diowei

Di Ao Micro is an integrated circuit design company focusing on the research and development, design and sales of high-performance analog chips. The company's main products include signal chain analog chips and power management analog chips, which are widely used in consumer electronics, smart LED lighting, communication equipment, industrial control and security, and medical equipment. Di Ao Micro expects its net profit to be a loss of between 35 million and 50 million yuan in 2024, a decrease of 28.7037 million to 43.7037 million yuan compared with last year.

The main reason for Dio Micro's 2024 performance loss is that the company has increased its market expansion efforts, increased customer share, and increased product sales, resulting in a significant increase in sales and administrative expenses. Although operating income has increased compared to last year, net profit will still be a loss due to these increased expenses.

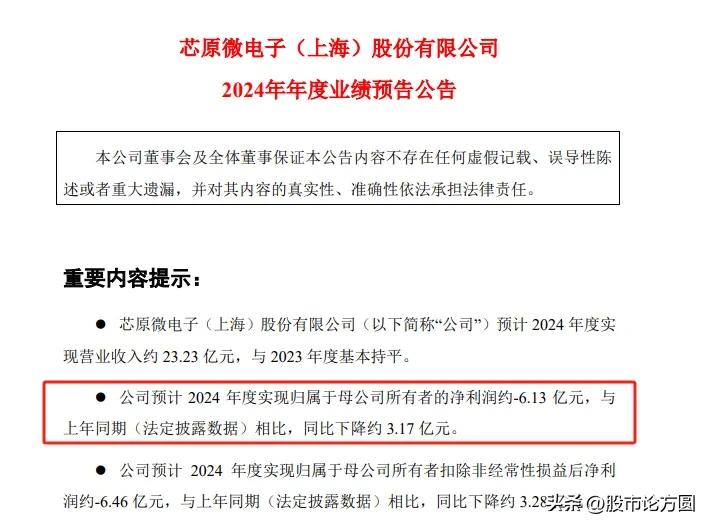

The seventh VeriSilicon

VeriSilicon is a leading company in the field of semiconductor IP licensing. As a leading company in China's independent semiconductor IP, VeriSilicon relies on its independent semiconductor IP to provide customers with platform-based, all-round, one-stop chip customization services and semiconductor IP licensing services. The company ranks eighth in the global semiconductor IP licensing market and is China's No. 1 semiconductor IP supplier. However, VeriSilicon expects a net loss of about 613 million yuan in 2024, a year-on-year decrease of about 317 million yuan.

The main reasons for VeriSilicon's 2024 performance loss include the slowdown in global economic growth, the downturn in the semiconductor industry cycle, and the impact of destocking. Specifically, the slowdown in global economic growth and the downturn in the semiconductor industry cycle in 2024 will lead to a decrease in market demand, which will affect the company's revenue. In addition, the impact of destocking also caused a decline in VeriSilicon's operating income and profits.

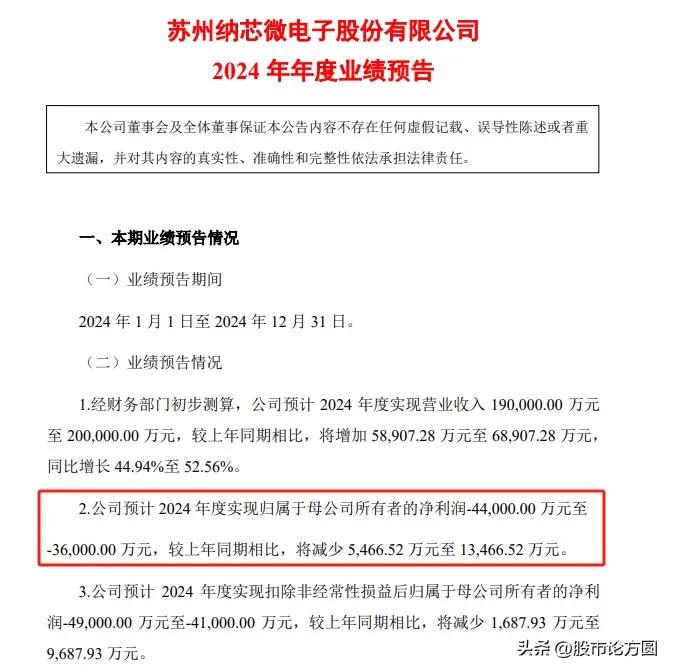

The eighth company: Nanochip

Naschip is a company that focuses on high-performance and high-reliability analog and mixed-signal chips, especially in the field of automotive analog chips. Naschip's products are widely used in automotive electronics, pan-energy and consumer electronics. Especially in the field of automotive analog chips, the company has formed a complete product matrix covering sensors, signal chains and power management. Naschip expects a net loss of between 360 million and 440 million yuan in 2024, which will increase losses compared with the same period last year.

The main reason for Naxinwei's loss in 2024 is the pressure on product prices and the decline in gross profit margin. That is, due to the impact of the overall macroeconomic environment and the intensification of market competition, Naxinwei's product prices are under pressure, resulting in a decline in gross profit margin compared with the same period last year. At the same time, the company's resource investment in R&D investment, market development, supply chain system construction, product quality management and talent development has increased, resulting in year-on-year increases in sales expenses, administrative expenses and R&D expenses.

In short, there are many cases of stock market crashes, so you need to know more about the basic situation of major listed companies so that you can make better decisions. You must know that investment is risky and you need to be cautious when entering the market.

-

上一篇

1500 nuclear bombs in 10 years, China's nuclear expansion is rapid, Russian experts boldly assess: o

In recent years, as the international situation has become i...

-

下一篇

As promised, on the day of Trump's inauguration, Chengdu released the next generation of aerospace p

On January 20, the inauguration ceremony of the 47th Preside...

相关文章

- China's GDP will grow by 5% in 2024 to 18.41 trillion US dollars. Will the gap with the United State

- In 2000, the US GDP accounted for 25.68% of the world's total, while China only accounted for 3.02%.

- The gender imbalance of the post-00s has further intensified | Chinese men shouted: It’s finally our

- Special report on the stock market | Another divorce case with sky-high prices in the A-share market

- CSRC releases | State Council Information Office holds press conference: Introducing the situation o

- The global stock market is changing rapidly. A full analysis of the latest developments of A-shares,

- It has fallen again. Why can’t the Chinese stock market continue to rise?

- With the joint efforts of six departments, the stock market is about to usher in a "hundred-bil

- The real land of women: men don't marry and women don't marry, they climb through windows at night a

- The mysterious ethnic group in the mountains of my country has a special custom that is too scary. G